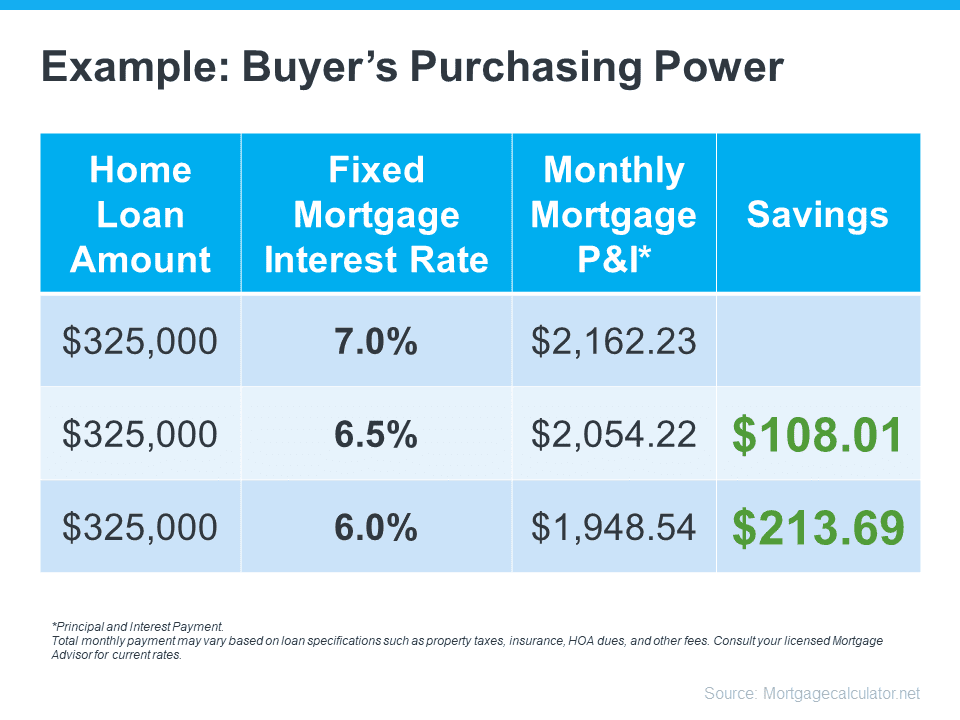

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

What This Means for Buyers

This is your moment! 💥 Lower rates mean you can afford MORE house for your money—hello, dream home! 🏡💫 Or, if you prefer, you can enjoy smaller monthly payments.

Whether you’ve been thinking about upgrading or snagging your first place, these lower rates are like finding the golden ticket.

Now is the perfect time to get out there and start house hunting!

What This Means for Sellers

If you’re on the fence about selling, now’s the time to jump in! 📈

With lower rates, there are more buyers ready to make a move, which means more eyes on your home and better chances of scoring a great offer!

This Friday, the 13th isn’t so scary after all—it could be your best-selling opportunity yet! 💵

How We Help

It’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your home buying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Send us a message to learn more about how we can help you buy or sell a home in DFW.